Upgraded Struggle: Summary of Core Technology Trends in the Projection Industry in 2023

Since 2023, the competition in technological progress in the projector industry has become increasingly fierce. The functional designs of light valves, light sources, lenses, screens, and product accessories are increasingly pursuing "brand independent discourse power" and "differentiated market consumption supply". This determines the competitive trend of the future projector market, especially the increasingly complex trend of intelligent projection for household consumption. The balance between technological progress, cost performance, and comprehensive experience will also determine who can rise.

1. The signs of the new system of light valve and the tricks of veteran players

Light valve is the core of digital projection display technology and the key to dividing brand camps. At least half of the brands in the industry never produce projector products with a certain light valve technology. In 2023, not only will new technologies take action in the field of optical valve technology; Old technology has also introduced new gameplay.

Firstly, the leading brand of 3LCD light valve, Epson, has launched a laser intelligent projector priced at 3000 yuan. The price of its previous generation product has decreased by 40%. This means that 3LCD technology has officially joined the competitive sequence of "mid to low end price" laser intelligent projection. At the same time, the DLP optical valve camp's "discount level" on 0.33 optical valves reached a peak in the third quarter of 2023 and continued to have a downward trend in prices.

In 2023, several new spring models of DLP camp projectors experienced a price drop of nearly 20% throughout the year. The price range is characterized by a decrease from over 3000 yuan at the beginning of the year to below 3000 yuan at the end of the year. More products with higher brightness and performance entering the market below 3000 yuan is one of the core sales strategies of the DLP camp. Among them, the entry of light valve products into the price reduction channel is an important factor.

The price decline of traditional 3LCD and DLP light valves is mainly due to the poor overall consumption of intelligent projection in the mid to high end price range; Low end market LCD products are upgrading to the price range of 2000+; The continuous decline in demand for traditional projection in the global market, as well as a decrease in demand for DLP and 3LCD light valves, have created market competition pressure. At the same time, the tight semiconductor process capacity pattern faced by DLP optical valves from 2020 to 2021 in 2023 is "gone forever", and the supply is in a relaxed state; In the car market, especially in the car front headlight market, the development of micro LED direct display headlights has also brought potential market pressure to the application of DLP light valves - these factors have driven DLP light valves to strive to maintain sales and occupy market initiative in the intelligent projection market.

Secondly, the emerging optical valve technology is making progress in 2023. The accelerated rise of LCD is an important variable. The main change in LCD is the launch of a new model with a brightness of 1000 lumens, and the price has also penetrated the 2500 yuan market; The launch of a new 4K technology model is expected to push the price of 4K intelligent projection display towards the range of 3000 to 4000 yuan, and has the possibility of further price reduction.

The upgrading and changes of LCD not only open up a broader space for personal growth and an upward step in experience; It also enhances its competitiveness with traditional projector technology. Especially in the price range of 2000-3000 yuan, the battle between the 1LCD and DLP camps is very intense. In this price range, 1LCD has found new growth points, while DLP technology is facing a defense battle in the "maximum sales range".

In addition to 1LCD, LCOS technology is also frequently mentioned in the industry. As a type of optical valve display category where local enterprises have already mastered manufacturing technology, LCOS was once expected to localize intelligent projection core optical valves. However, compared to the development situation in the three years 2020 to 2022, the enthusiasm for the development of the local enterprise LCOS market seems to be decreasing.

Industry analysis suggests that: 1. The ratio of 3LCOS to 3LCD, as well as the ratio of 1LCOS to 1LCD, are both cost disadvantages for increasing silicon-based CMOS. Although there have been some upgrades in light efficiency performance, Lcos is not a good choice in the current industry's emphasis on price wars. For end brand enterprises, the risk of introducing new technology lines is high. Not only are there concerns about the quality of new technologies, consumer recognition, and supply chain stability, but there are also strong opposition from existing light valve suppliers

“

Difficulties do not come from technology, but from commercial operations. Industry insiders point out that after DLP optical valves bid farewell to the stage of tight supply, the prospects of local LCOS projection optical valves have become more uncertain.

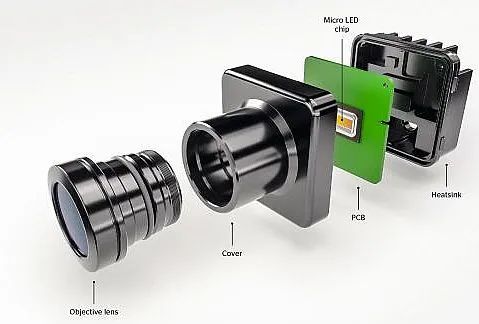

However, another new light valve technology - also known as a new projection system technology - micro LED projection is emerging. On the one hand, Changhong has officially launched the "Key Technology Research on High Brightness Micro LED Projection Display" under the "14th Five Year Plan" National Key R&D Program "New Display and Strategic Electronic Materials" led by Changhong; On the other hand, in the second half of 2023, Digital Optics announced the successful debugging and lighting of China's first Micro LED silicon-based driver car pixel headlight chip, with over 160000 pixels. Guoxing Optoelectronics announced the completion of a micro LED screen with a 7.5 micron pixel spacing, which has the characteristics of high resolution and lower power consumption, and can be used for micro projection display technology.

Micro LED projection is a technology that integrates light valve and light source, utilizing high-density pixelated and bright micro LED arrays to achieve integrated lighting display. At present, there are relatively mature application scenarios and products on car headlights, which also compete with DLP digital headlights and become one of the future display technology routes for AR glasses. For projection displays, micro LEDs need to maintain their current brightness levels to achieve higher pixel integration, colorization, and more user-friendly cost control.

Some companies, including Changhong, believe that micro LED projection technology is worth researching and may replace DLP and 1LCD in the future, as one of the future technology routes with huge potential in the smart home investment and conventional brightness commercial education projection markets. It has the advantages of high light efficiency, simpler structure, local enterprise technology chain, and completely independent and controllable supply chain.

Overall, the characteristics of the projector valve market in 2023 are loose supply and fierce competition; The prices of traditional DLP and 3LCD light valves are falling, the performance indicators of 1LCD light valves are improving, and the high-quality innovation of local light valves is still in the "path exploration" stage - LCOS is cooling down, and micro LEDs are heating up.

2. The high-end value of lens zoom, and the difficulty of landing ultra short focus

The large screen of projection display technology relies on the amplification effect of optical lenses on the image. Therefore, the lens is the core component of projection display, and the upgrade of lens products has created a new category of "laser televisions". However, compared to other electronic technology components, the maturity of the optical industry chain also determines that it is difficult for projection lenses to undergo qualitative changes.

The surprise of the projection lens market in 2023 was only the new product launched by Nut in October: Nut O2 Ultra. This product uses a new short focus lens with a projection ratio compressed to 0.18:1, which can project up to 100 inches from the wall at a distance of 16.8cm. This is another product that breaks through 0.20:1 after Epson's 0.16:1 projection ratio

Having a projection ratio of less than 0.20:1 can achieve true color display on TV cabinets: the width of a typical TV cabinet is 45-60cm, while the width of the Nut O2 Ultra body is only 29cm, and its farthest distance from the wall during projection is only 45.8cm, which can truly achieve easy large screen projection on standard TV cabinets.

For the new lens application of 0.18:1, Nut has two products: O2 Ultra 4K, a three color laser with 2800CVIA brightness and 98% speckle elimination rate, priced at 9999 yuan, ushering in a new era of "laser TV economy". At the same time, Nut O2 also has a projection ratio of 0.18:1 and a 750CVIA lumen tricolor laser source, priced at 3499 yuan—— Compared to similar products or old versions of nuts in the market, the 0.18:1 new lens does not have any "premium" effect.

In fact, in recent years, with the shrinkage of the commercial and educational projection market and the market pressure from large-sized LCD TVs on laser TVs, the ultra short focus lens industry chain has faced tremendous pressure: 1. The demand for traditional products has decreased; 2. Traditional technology and performance indicators are not sufficient in the household market. With the release of the Nut 0.18:1 product, the market and application value of ultra short focus may be redefined.

In addition to the advancement of ultra short focus lenses, in 2023, medium and long focus zoom lenses, as an ancient and mainstream choice in the traditional projection market, are also increasingly being selected by more and more intelligent projection options. The intelligent projection market mainly targets household demand, and consumers are more sensitive to economy, which leads to most intelligent projectors using shorter focal length fixed focus technology to reduce costs.

However, although the cost of fixed focus projection is low, it also sacrifices the flexibility of zoom projection. After 2021, the high-end intelligent projection market with a price of over 5000 yuan will accelerate its development. Over the past three years, the market share has continued to double. In 2023, the proportion of high-end intelligent projection market will increase to about 10% of the overall intelligent projection market. These high-end products have sufficient price and cost space, as well as flexible and efficient demand on the demand side, equipped with medium and long focus zoom lenses. From the perspective of market development in 2023, medium and telephoto zoom lenses may become one of the mainstream high-end intelligent projections in the future.

In addition, ultra short focal reflective lenses can also be zoomed in. However, considering that the target of ultra short focus lens products is wall mounted applications, the value of ultra short focus disappears after zooming. Therefore, ultra short focal reflective lenses with zoom are inevitably just a few alternative products. The technological direction for more ultra short focus lenses is inevitably to move forward in "reducing costs and technical difficulties with fixed focus" and "shortening the focal length to enhance wall adhesion value".

"Cheaper, more flexible, and shorter focus" are the three main technical directions of lens products in projection applications. In 2023, with the intensification of industry price wars and the upgrading of competition pressure from innovation and low cost, industry enterprises are paying more attention to lenses. The competition of lens skills will also become one of the focuses of differentiated products and the mid to high end market in the future.

3.Upgrade of projection light source, intense mixing, and significant increase in laser power

If the most lively technological event in the projection industry in 2023 is undoubtedly the "light source saliva" war between Nut and Jimi at the beginning of the year. It is also this great war that has made the selection of light sources a top priority in the projection market, and even has a general trend for manufacturers such as Labang to stand in line.

On the one hand, hybrid lighting has received support from many brands. By the end of 2022, companies such as Jimi, Shimeile, and Guangfeng have all launched their own hybrid light source solutions. Using the wide spectrum of LED to solve laser speckle problems and bring economic benefits; Improve the color and accuracy performance of products by using the pure spectrum of lasers. "Bring all the strongest points of the two major light sources, laser and LED," industry insiders say that mixing light is a "clever idea" and "mature system.".

On the other hand, Nuts, Hisense, Changhong, and others have become "pure laser factions". These brands believe that tricolor lasers should rely on technological advancements to solve speckle problems and achieve "perfect" image quality in one step. Some analysts believe that the essence of mixed light is that many products and enterprises start from the bottleneck of LED and demand "space" from lasers. This approach will inevitably lead to pure laser as the ultimate endpoint of progress.

Of course, from the existing technology and products, both hybrid and pure lasers are still on the way to progress and are not perfect enough. And more companies have products in LED, laser, mixed light, tricolor laser, and even in the development of micro LED, a new projection system technology that does not require additional light sources. Today's light source battle is more like a "market education" show, not the "ultimate battle". The continuous progress of light sources in the future, and even the disruption of projection technology, will inevitably bring better products.

If implemented from a practical perspective, most of the products in the current intelligent projection industry chain are still LED light sources. Because this technology is low-cost and also solves the brightness requirement of 2000+lumens. On the other hand, monochromatic lasers are mainstream in the business education and engineering markets because of their high brightness and low cost.

As for hybrid and tricolor lasers, they still belong to the "high-end category" in every circle of business education, engineering, and household use. Further solving the cost issue is the most urgent task for future innovation in new light sources.

Setting aside the technical system and only focusing on the core performance indicator "brightness" of light sources, the industry will continue to make progress in the direction of continuous "brightness" in 2023. On the one hand, monochromatic lasers and LED light sources are continuing to increase their brightness scores. Especially with the advancement of the new generation of blue lasers, monochromatic laser products are achieving rapid market share growth due to their outstanding performance in miniaturization and high brightness. On the other hand, due to the use of more light-emitting devices, the overall brightness of tricolor lasers and mixed light is difficult to achieve even at a very low level. Obviously, these new technologies will inevitably drive the upgrading of the light source industry towards brightness.

The bottleneck of continuous brightness of LED light sources is also considered to be the reason why lasers will definitely replace LEDs in a larger proportion in the future, whether the answer is monochromatic laser, mixed light, or tricolor laser. Industry insiders have stated that the preferred laser source for projectors above 2000 lumens will become a highly certain "big trend" in the industry.

In the battle for new light sources in 2023, the position of traditional mercury lamp products is even more precarious. For example, in the third quarter of 2022, Epson launched a batch of mercury lamp smart home investment products with high brightness and low price, and its market performance was very average. This year, Epson's new products at the same price point have been replaced with laser intelligent projection: although the brightness index has decreased, the market share is better.

More importantly, the main application range of mercury lamp products in the retail business market has encountered more competition from large-sized LCD interactive tablets and LCD displays. As the price of 75/85 inch LCD drops, the price advantage of mercury lamp commercial projection cannot compensate for its visual disadvantage, and the market is still in a period of rapid shrinkage. This further compresses the "consumption space" of mercury lamp projection.

In 2023, mercury lamp projectors have lost their basic market share! Not only has the traditional demand market been under competitive pressure, but more importantly, the cost of LED and laser light sources with a brightness of over 2000+is increasingly pressing

4.Projection screens resist light and look forward to a "hard future"

The core parameter that determines the product experience in the traditional projector application market has always been "brightness". But if the brightness is already sufficient, what does further image quality improvement rely on? The answer is "screen"! In 2023, around the projection market, the upgrade of traditional screens to "optical anti light screens" will enter a new stage - a relatively complicated stage:

There are two better pieces of news: the first is that local optical screens and anti light curtain technologies continue to improve. We have achieved certain development and breakthroughs in product cost, localization level, ultra-thin development, and curlability. Secondly, from the application side, especially the projection host enterprise side, the emphasis on screens is increasingly increasing. For example, Dongfang Zhongyuan has launched "Laser Projection Electronic Blackboard Technology", which applies ultra short focus projection and anti light curtains, embedded in classroom blackboards, to form a better experience solution.

There are also two pieces of bad news: first, the laser TV market is not developing well. The low price of large-sized LCD TVs has quickly taken over the traditional living room large screen C-position of laser TVs. The value of laser TV has entered the "adjustment stage" - further low-cost and large-sized development towards 100+is the main trend in the future. Laser TV was the "core pillar" of the early market for anti light curtain products. The downturn in the laser TV market is a blow to light screens.

Secondly, the cost reduction is not ideal. After a rapid price decline from 2020 to 2021, the volatility of cost and market price of anti light curtain products has significantly narrowed. Especially in 2023, during the overall market demand downturn, the willingness to lower prices is not strong - because the projection market is sluggish, and the proportion of low-end intelligent projection products continues to rise. The potential incremental market for anti light curtains is limited, and lower prices are considered to have little contribution to consumer driving force. The industry has temporarily lost interest in "competing for the market at a low price".

However, in addition to these short-term variable factors, the industry still remains optimistic about the future market value of "anti light curtains". Industry experts believe that anti light curtains are not an independent product category, and their popularity is highly dependent on factors such as: 1. the demand for mid to high end projection consumption, 2. the size and technological level of the high-end ultra short focus market, 3. mid to high brightness models, as well as the cost price of ultra short focus technology projection, and 4. the cost price of anti light curtains themselves.

Many of these factors are dependent on the projection host. Therefore, only a true change in the pattern of the host consumer market can promote the development of high-quality screens such as anti light screens. Although the development of high-quality screens will further provide assistance for the "high-quality" growth of projection consumers; But the "core position" of the host cannot be shaken - anti light screens and projectors, just like monitors and PC hosts: although the former is also important, the latter is more decisive, especially when the budget is limited, the latter is the focus of the consumer market.

So, in 2023, the anti light screen market can see many market restraining factors, but there are also good news in the long run, such as the further breakthrough of ultra short focus, the continuous decline in prices of high brightness models, and the booming development of high-end intelligent projectors priced above 5000 yuan. The mid to high end screen market, such as anti light screens, will not experience explosive development in the short term, but in the long run, it will be a rising category with a slow and steady flow of fine water.

5.Upgrade of accessory function design for projection products, increasingly pursuing a comprehensive experience

In addition to the advancement of core technologies such as light valves, light sources, lenses, and screens, smart projection and other household products in the projection industry will also be further upgraded in auxiliary applications in 2023. Among them, in addition to certain improvements in precision and speed such as intelligent autofocus and trapezoidal correction, and continuous progress in AI voice function, the upgrade on the "bracket" is also very obvious.

Smart projectors, especially in the micro projection category, inevitably require a "stand" when applied. In addition to conventional vertical tripods, many situations require desktop brackets. As netizens often say, "To play WeChat, you need a few books" - using cushion books to adjust the height and angle of the product's projection screen.

One of the problems can be effectively solved by equipping the projector product with brackets, gimbals, etc. For example, Xiaoming's 2023 new product V1 comes with a thoughtful standard integrated lightweight bracket, accurately grasping the pain points of consumer product applications. For example, the Nut O2 Ultra 4K is equipped with an electric micro gimbal device, which can freely adjust the image height from 0 to 35cm without losing image quality.

Equipped with a bracket or pan tilt, it has been extended to 1 LCD projection and laser TV product lines. This is a new achievement in the convenience development of home investment products in 2023. It also represents the further popularity of the concept of product application friendly design represented by attachments.

Industry experts point out that projector applications themselves have a high degree of "programmability". It can be said that the details outside of the host are equally important products. Manufacturers can design reasonable attachments for their products, including screens, brackets, etc., which can greatly reduce the trouble for consumers to choose and solve certain installation and decoration problems, achieving a more "easy" landing experience for the product.

In addition to core technologies, upgrading the peripheral experience is also a highlight of future product innovation. The bracket and pan tilt are one breakthrough point, while the matching screen is another breakthrough point. Industry insiders emphasize that these components can be either standard or optional, or a combination of multiple functions and solutions. Especially for the screen and gimbal brackets, it is not ruled out that they can be designed to be electrically and intelligently linked with the projector in the future, further enhancing the comprehensive experience of the system solution.

In summary, although the projector industry has temporarily slowed down in terms of "increasing quantity" in 2023, there is an increasing sense of urgency in "improving quality". In every aspect of innovation, manufacturers are putting in a lot of effort to promote the formation of a new competitive model of "quality to price ratio" in the industry, which seeks benefits from quality upgrading and expands the market with quality upgrading, from dimensions such as higher experience, better use, and lower prices.